Consider the following client claim examples:

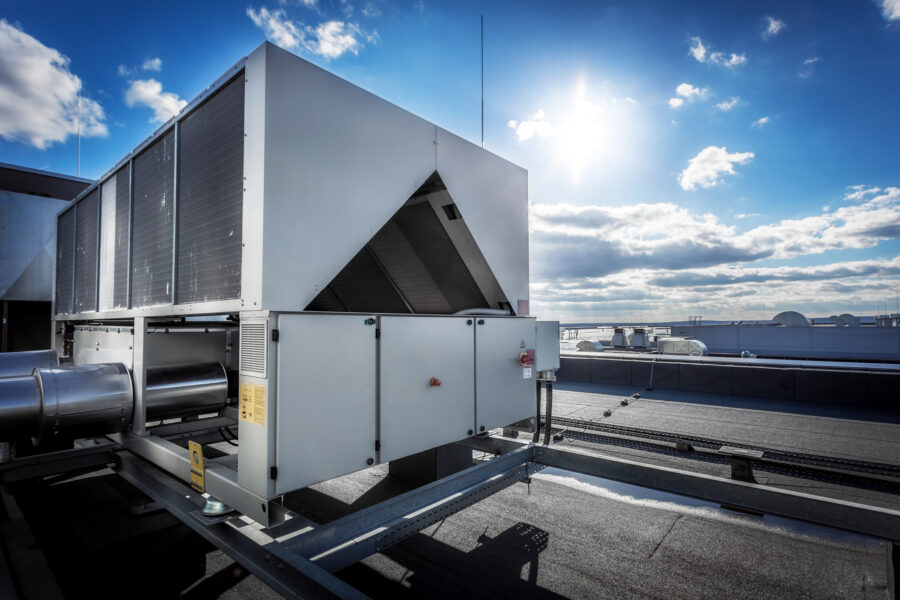

HVAC

An air conditioning unit was replaced on the roof of a commercial building. The unit fell through the roof, destroying itself as well as damaging the building and its contents. It was discovered the contractor failed to install proper rooftop foundation supports. Although general liability insurance paid to repair the building and replace the damaged contents, it could not pay to replace the destroyed air conditioning unit. Cost of claim not covered by general liability: $25,000.

General Contractor

The GC ordered roof trusses from a new manufacturer and installed them plus the decking. Upon deck inspection they discovered the wrong trusses were ordered as they were not engineered for proper snow load in that county. The deck had to be removed and the trusses replaced. Claim cost: $40,000.

Fence Installation

The contractor misread site plans and installed a fence on the incorrect side of property lines. The fence needed to be removed and reinstalled. Claim cost: $35,000.

Unlike general liability, contractor errors and omissions insurance does not need to be triggered by an event, but applies when a financial loss occurs. A popular contractor errors and omissions insurance policy states it protects against “an error, omission, or other act that causes liability in the performance of professional services for others by you or by any person or entity for whom you are liable.” Notice the protection extends to work performed by the contractor or by their subcontractor. Practically, contractor errors and omissions insurance protects against:

Faulty Workmanship

Some mistakes are easily corrected, but many are costly. Even when proper materials are used, if installed in an incorrect manner, replacement can be expensive and time-consuming. For example, if an electrician installs the incorrect gauge of wire throughout a building, the cost of ripping it out and reinstalling could be immense.

Negligent Errors or Omissions

Plans can be misunderstood, installation instructions difficult to understand, or guidelines and local codes updated. Many opportunities exist for honest mistakes.

Use of Defective Materials

In the course of time certain products or materials can be found to be defective and require replacement. Many recent examples exist, one being polybutylene pipes installed by many plumbers through 1995. These pipes weaken over time and cause homes to flood. Similarly, PEX tubing is widely used today and performs well, but new fitting designs present potential failure points and liability for the plumber. Another example is Chinese drywall which causes corrosion to wiring and emits a terrible odor.

Contractors Professional Liability

Certain contractors, particularly general contractors or construction managers, offer advice or provide design services upon which others depend. These services can be inhouse or subcontracted. Examples can range from designing on-the-fly solutions at the jobsite to full construction plans or project management. In such cases, the contractor can be liable for damages should that advice be incorrect or the services inadequate. Instead of the contractor’s product being affected, damages are caused to other parties. This risk is protected by contractors professional liability insurance, which may or may not be included in contractors errors and omissions coverage. Insurance policies differ, and some insurance carriers make a distinction between contractors E&O versus contractors professional liability, insuring them separately. To better understand your coverages, read your insurance policy or ask your insurance agent.

This content is provided by our partners at Bankers Insurance. For more information or to start the process of getting a quote, click here.